More Information?

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua Egestas purus viverra accumsan in nisl nisi

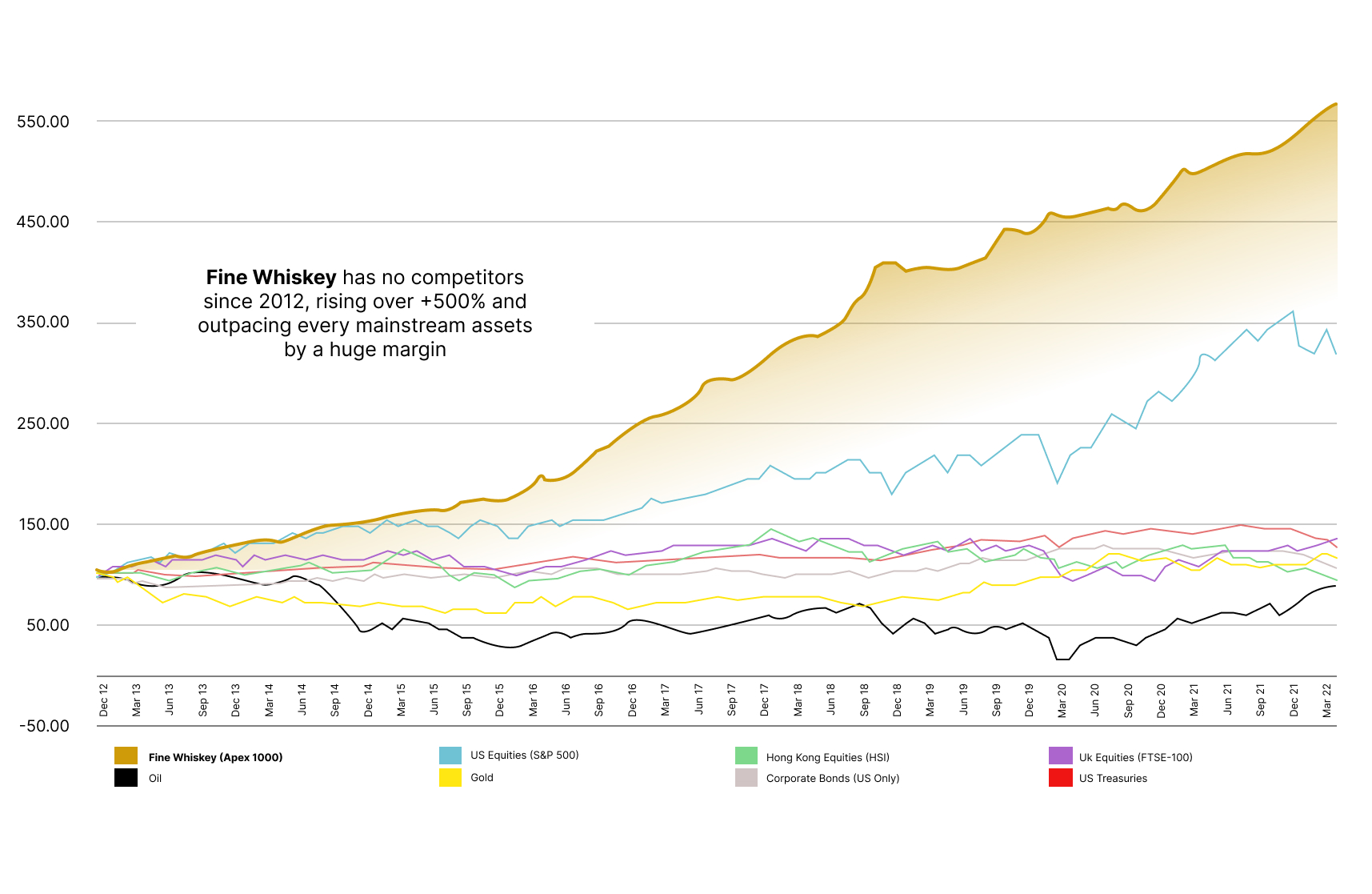

Get double digit returns from a recession proof American asset.

Asset-backed alternative investment with double digit returns

Outperformance over traditional investments and other alternatives

Low volatility; whiskey values are much more stable over time

Recession proof – demand for whiskey is consistent in good and bad times

Inflation hedge

Non-correlated to the markets, providing portfolio diversification

Add Your Heading Text Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua Egestas purus viverra accumsan in nisl nisi